We’re thrilled to share some exciting updates we’ve made to our product this month! These enhancements are designed to significantly improve users’ experience on our platform. Read on to find out what’s new!

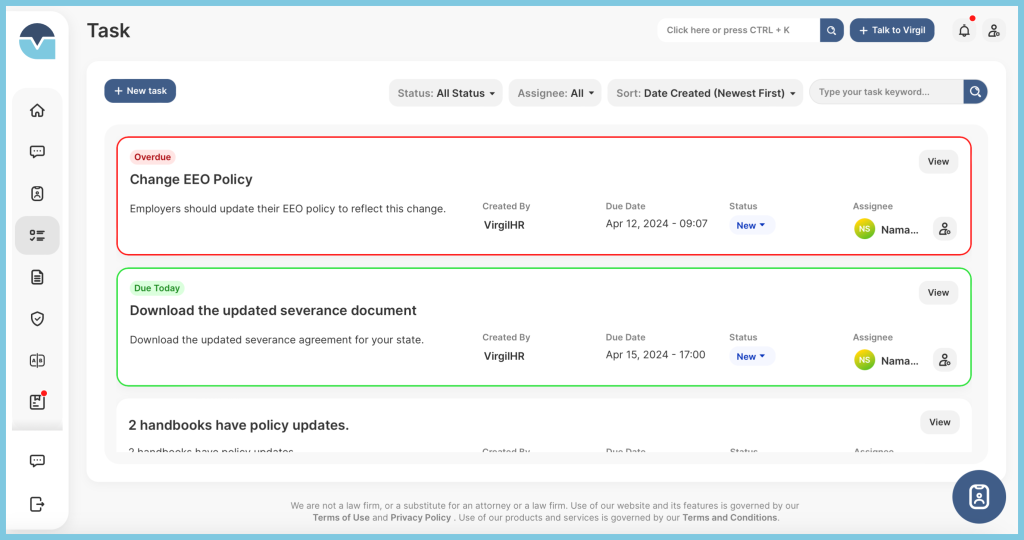

Enhancements to the Legal Updates Experience

We have made the legal updates more personalized and actionable.

- Automated Tasks: Never miss a beat! Based on new regulations, we’ll now automatically add relevant tasks to users’ Task List to keep their HR practices compliant.

- Personalized Updates: No more information overload. Users can now get updates tailored to their location preferences ensuring they directly impact their workflow.

- Smart Reminders: Timely nudges keep users on top of compliance deadlines, so they can take action before it’s too late.

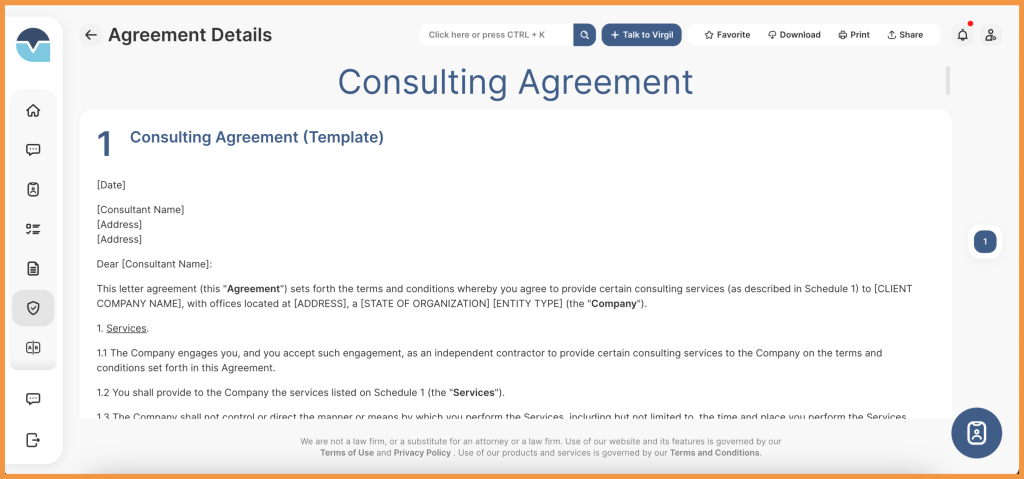

Consulting Agreement

Our consulting agreement outlines the working relationship between a user’s organization and a consultant, allowing them to clearly identify their responsibilities, pay, expectations, and other terms and conditions of their services.

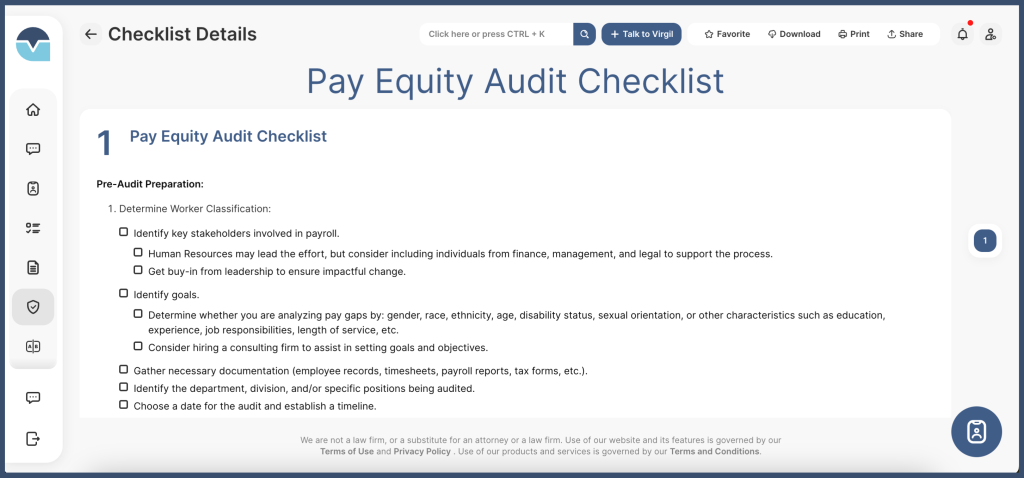

Pay Equity Audit Checklist

By following this checklist, organizations can conduct a comprehensive review of their compensation practices to identify and address any disparities based on gender, race, ethnicity, or other protected characteristics, promoting fairness, equity, and compliance with legal requirements.

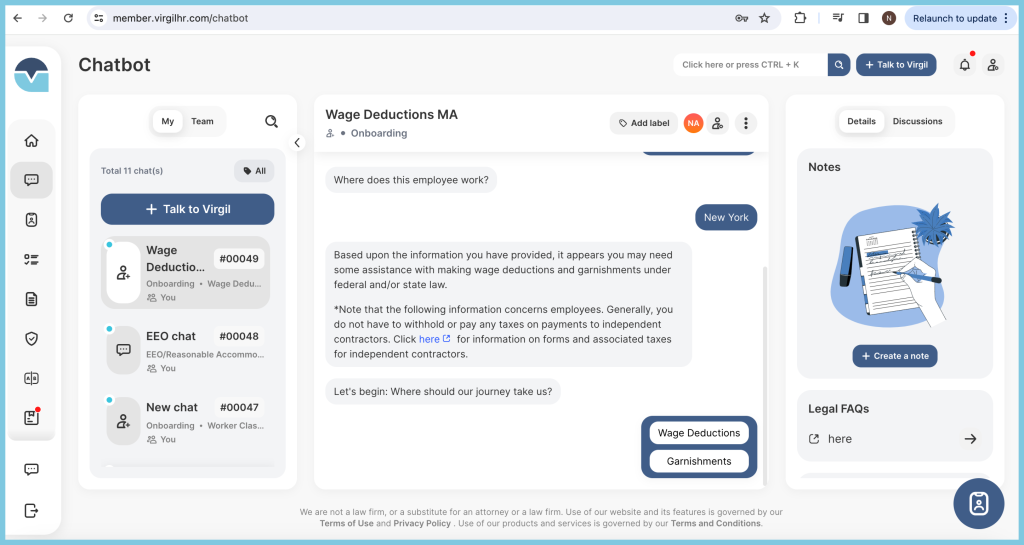

Wage Deductions & Garnishments Workflow

This interactive workflow covers the various and often complex federal- and state-level deduction and garnishment laws. Users are guided through the required, permitted, and prohibited types of deductions, and provided guidance on how to carry out different types of garnishment orders.

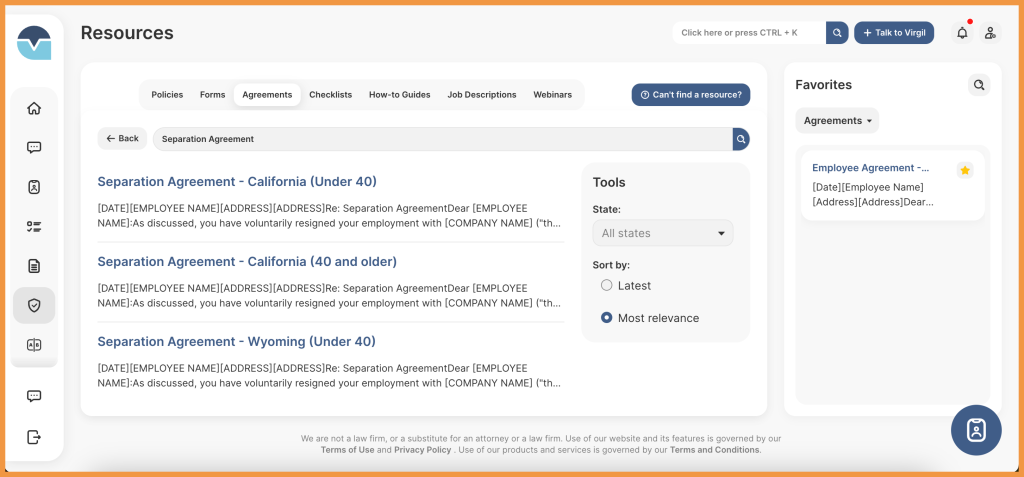

State-Specific Severance Agreements

State-specific employee severance agreements are compliant with specific statutory requirements under federal law, such as those required by the Age Discrimination in Employment Act (ADEA) and the Older Workers Benefit Protection Act (OWBPA), as well as requirements under state law. Two versions are available for each state: one for employees age 40 and older (which include heightened employee protections), and one for employees younger than 40.

If you’re interested in learning more or exploring these updates in action, schedule a demo with us today!