We have made significant updates to the VirgilHR platform over the past few weeks and are excited to share them with you!

New Handbook Upload Feature

This powerful tool allows you to:

- Effortlessly upload your existing handbooks.

- Benefit from a comprehensive analysis that identifies missing national and state-specific policies.

- Gain insightful recommendations to ensure your handbooks are up-to-date and compliant.

- This feature is in beta, so you’ll be among the first to experience its potential and help us refine it.

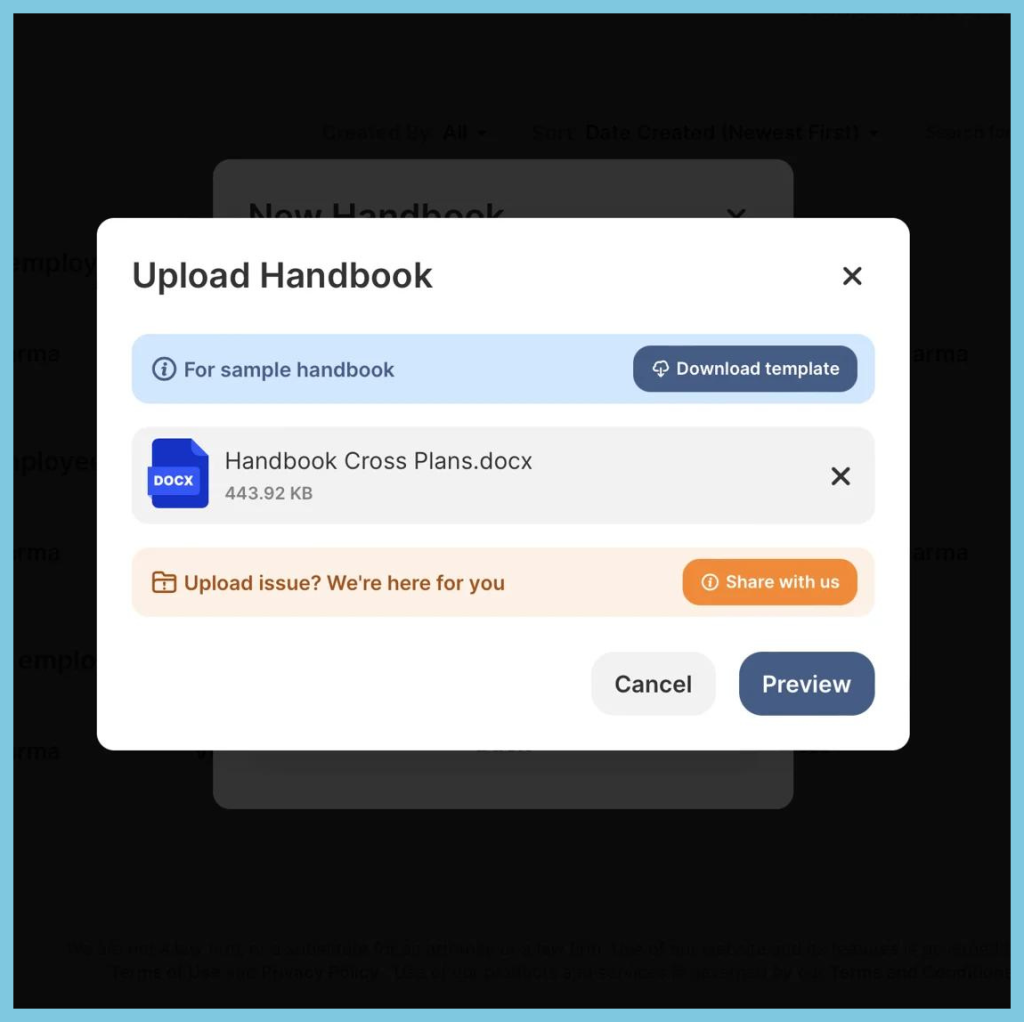

Here’s how it works:

- Head over to the Handbook Builder section.

- Click on “New Handbook” and provide the basic handbook information.

- Select “Upload Handbook” (beta) and choose your document.

- Receive a list of missing policies.

- Make necessary edits and complete your handbook with confidence.

Remember, this feature is currently in beta testing, so you may encounter some minor limitations. We appreciate your understanding and feedback as we work towards a full release.

New March Worker Classification Workflow

The new Independent Contractor rule comes into effect on March 11th. To help you navigate this change smoothly, we have introduced our new chatbot workflow dedicated to answering all your questions about the Independent Contractor rule.

100+ New Resources

We have made major enhancements to our Resources section, including 100+ new resources across three new categories:

- Comprehensive How-To Guides: Master complex compliance topics with step-by-step instructions, industry best practices, and real-world scenarios.

- Actionable Checklists: Stay organized and ensure nothing slips through the cracks with our detailed checklists covering critical HR compliance obligations.

- Job Description Templates: Attract top talent with expertly crafted job descriptions that comply with all relevant hiring regulations.

We hope you enjoy these new resources! If you’re interested in learning more or exploring these updates in action, schedule a demo with us today!

Reminder: New Independent Contractor Rule Effective Next Week!

As a reminder, the Department of Labor’s final rule on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act (FLSA) is effective on March 11, 2024. The final rule rescinds the Independent Contractor Status Under the Fair Labor Standards Act rule (2021 IC Rule) that was published on January 7, 2021, and replaces it with a six-factor analysis:

- Worker’s opportunity for profit or loss;

- Investments made by the worker and the employer;

- Degree of permanence of the work relationship;

- Nature and degree of control over performance of the work;

- Extent to which the work performed is an integral part of the employer’s business; and

- Use of the worker’s skill and initiative.

Instead of using the “core factors” set forth in the 2021 IC Rule, the final rule returns to a totality-of-the-circumstances analysis of the economic reality test in which the factors do not have a predetermined weight and are considered in view of the economic reality of the whole activity.

You can access the final version of the rule here. Additionally, you can visit the “Wage and hour” section of our Worker Classification chatbot workflow, which will provide relevant information and guide you through the new rule.